Disclaimer: Neither I nor my team are officially registered with SEBI as analysts. However, the insights we’re about to share are a result of our diligent analysis and collective expertise, aimed at enriching your knowledge about the market. 📈 While we strive to provide valuable information, it’s important to note that our views should complement rather than replace professional financial advice. 💼 So, before making any investment decisions, we highly recommend consulting with a certified financial advisor and conducting your own research. 📚 Your financial journey is a collaborative effort, and having all the right pieces in place ensures a successful outcome. Happy exploring! 🚀

Dear Readers,

Welcome to a journey of discovery in the realm of long-term investing! 🚀 Today, I’m excited to share insights that could potentially elevate your trading knowledge and empower you to make informed decisions in the stock market. 💼 We’ll be exploring the fascinating world of stocks reaching their all-time highs, uncovering the strategies and techniques that could lead to long-term prosperity. 📈 So, let’s keep our eyes peeled and our minds open to the possibilities!

Understanding Stocks at All-Time Highs

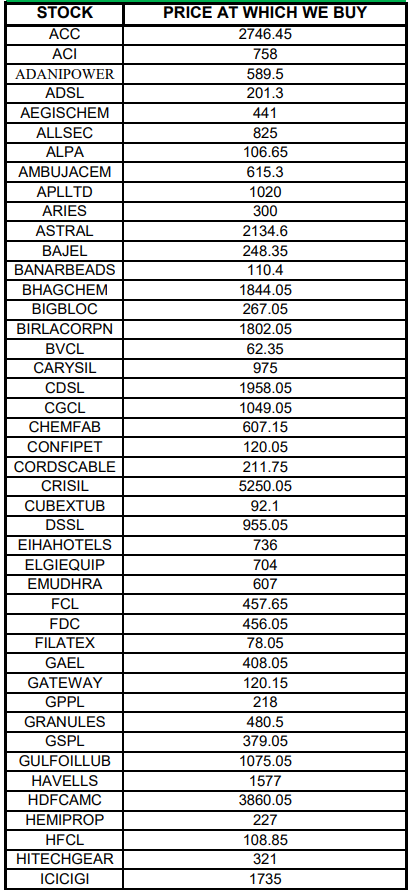

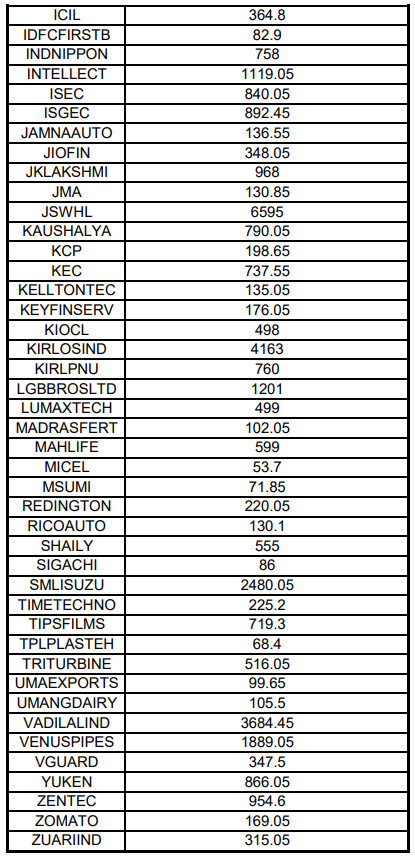

At the heart of our exploration lies the phenomenon of stocks reaching their all-time highs. 📈 These stocks are displaying strong upward momentum, indicative of positive market sentiment and potential future growth. By identifying such stocks, investors can capitalize on the momentum and ride the wave towards long-term wealth accumulation. 🌊 Below is the list of analyzed Stocks.

Continued..

Now that we’ve identified stocks at all-time highs, let’s delve into strategies for long-term investment success. 🎯 Investors can set their own targets based on their long-term goals while also considering short-term gains. While short-term targets, such as achieving a 6 percent return, can provide immediate gratification, it’s essential for traders and investors to set personalized long-term targets aligned with their financial objectives. Additionally, determining stop-loss levels based on individual risk capacity and thorough analysis is crucial for protecting capital and managing risk effectively. Remember, adaptability and flexibility are key to successful long-term investing.

Strategizing for Success: Techniques for Long-Term Investment Successful

long-term investing requires a strategic approach and disciplined execution. 🎯 When investing in stocks at all-time highs, it’s crucial to employ techniques that maximize potential returns while mitigating risks. Here are some strategies to consider:

Harnessing the Power of Momentum Investing: By identifying stocks with strong upward momentum, investors can capitalize on trends and ride the wave of growth to achieve long-term success.

Setting Realistic Targets for Stocks at All-Time Highs: Establishing clear targets based on thorough analysis and market conditions helps investors stay focused on their objectives and avoid irrational decision-making.

Implementing Effective Risk Management Strategies for Long-Term Growth: Diversifying portfolios, setting stop-loss orders, and managing position sizes are essential risk management techniques that help protect capital and preserve wealth over the long term. 🛡️

Partnering with Experts: Leveraging Insights for Informed Decisions

While navigating the stock market can be daunting, investors don’t have to go it alone. 🤝 Partnering with financial advisors and experts can provide valuable insights and guidance that enhance decision-making and maximize investment potential. Here’s how investors can benefit from expert advice:

- Collaborating with Financial Advisors for Personalized Guidance: Financial advisors can offer tailored advice based on investors’ financial goals, risk tolerance, and investment preferences. By working closely with advisors, investors can build personalized investment strategies that align with their objectives.

- Validating Investment Strategies with Professional Opinion: Seeking validation from experts helps investors gain confidence in their investment decisions and ensures they’re on the right track towards long-term financial success.

- Enhancing Long-Term Investment Approaches through Expert Analysis: Expert analysis provides investors with valuable insights into market trends, industry dynamics, and individual stocks, helping them make informed decisions that drive long-term growth and prosperity. 💼

Conclusion

As we conclude this journey into the world of stocks at all-time highs, I hope you’ve gained valuable insights and inspiration to navigate the markets with confidence and resilience. 🌟 Remember, successful long-term investing requires a combination of knowledge, discipline, and patience. By harnessing the power of momentum, setting realistic targets, implementing effective risk management strategies, and leveraging expert insights, you can position yourself for long-term success in the ever-evolving world of the stock market. 📈 Here’s to your journey towards financial prosperity and wealth accumulation! 🚀